Nab Top Dollar for Your Business with Up-To-Date Financial Records

So you’ve decided it’s time to prepare to sell your business. It’s not a decision you’ve come to lightly. The question is, how do you ensure the most ideal outcome?

Enter business value drivers. Value drivers are common to all businesses in all industries and simply increase the value of your business. These are integral and must be in place before you ever take the first step in selling your business.

Hopefully, you’ve been working toward the end goal from day one, but if you haven’t, let’s go straight to the number one value driver to target when selling your business.

Keeping Up-To-Date Financial Records

The worth of your business isn’t determined by its value under your control but by its transferable value. Its true value is in its probability of cash-flow sustainability and growth in new hands. This is where up-to-date financial records come in.

The leading deal breaker in any business purchase venture is poor financial documentation and lackluster financial integrity. If you want to get top dollar for your company, make sure your books are clean and can give your potential purchaser the information they need right away.

The last thing you want is for your potential buyer to walk away or to get less than you could have just because you neglected to offer clear proof of your financial claims. Take BDC’s advice regarding getting your financial records up-to-date before selling:

“…make sure you are organized and ready to respond to questions. A potential transaction can get derailed at the due diligence stage—particularly in a buyer’s market.”

Because potential purchasers will always conduct due diligence before buying your business, it only makes sense to have all your financial records ready to support your claim that your business is consistently profitable and your purchaser would be crazy to let it go.

Clear, Current Financial Records Prove Transferable Sustainable Cash Flow

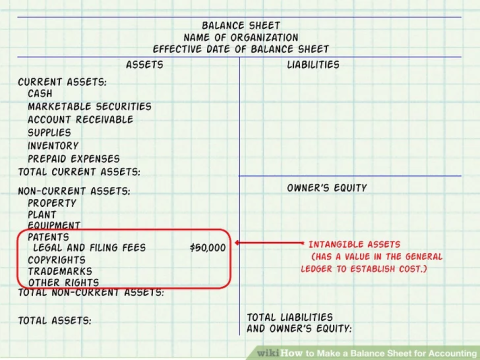

The most effective way to demonstrate the transferable value of your business to your buyer is to present them with reliable financial controls. Keeping all your financial records clean and current proves not only that your company’s full potential is being achieved and your business is well-managed, but that it can and will continue to be consistently profitable. Beyond all that, reliable financial records can also protect your assets and support your business' leverage, operational efficiency, and solvency.

The key takeaway here is that the better shape your financial records are in, the easier the due diligence will be for your potential purchaser, resulting in a better impression and a better purchase outcome.

Up-To-Date Financial Records Scream Transparency

Buyers today are taking their time deciding what and when to buy. Buyers examine all aspects of a business now, and in more detail than perhaps they once did. That makes transparency more important than ever. Transparency equals trustworthiness, and that makes all the difference.

“Prospective buyers want as much transparency as possible…and they’re contemplating longer.”

So if buyers are contemplating longer, it would serve you well to get your books in order, if they’re not already, going back at least 3 years. This will give purchasers all the information they could possibly want without having to dig or ask for it.

And having clean, organized, up-to-date financial records such as year-to-date results providing a prospective buyer 3 to 5 years of year-end financial statements in a review format prepared by an external qualified accountant, together with tax returns, will give a potential purchaser the answers to their questions before they’re even asked.

Documents You Need to Keep Current and Organized

That said, which documents should you prioritize after your year-end financial statements are done? Which are essential to keep current and organized?

The first—and most important—is to ensure you have 3 to 5 years of your business tax returns at the ready. Not only will they confirm the revenue, net income, and tax payment information declared in your financial statements, but they will also prove you’ve filed and paid your taxes consistently and are not in arrears.

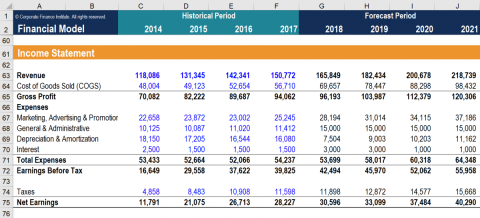

Integral to proving your company’s profitability, the next thing a possible buyer wants to see is the year-to-date income statement. It should clearly illustrate your business’s revenues, costs of goods sold, operating expenses, operating profits, and net profits.

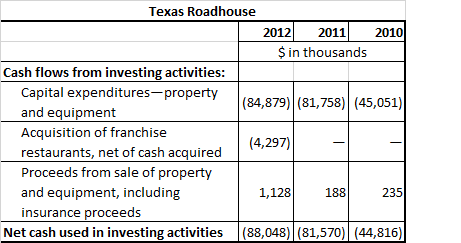

The final essential document you should have in place when you decide to sell is your year-to-date cash-flow statement. This is the black-and-white breakdown of all the money coming and going within your business. Many of the questions your purchaser could ask fall in this category, so having your cash-flow statement will stave those off and immediately show your company’s operating, investing, and financing cash flow. Not only that, but it tells your buyer what really matters: how much working capital your business actually has to work with each month.

And here are a few other documents you’d be wise to have prepared when you go to sell your business:

- Proof of business ownership

- Business licenses

- Payroll summaries for 1 year

- Outstanding accounts payable

- Outstanding accounts receivable

- Current loan documentation

- Lease contracts

- Sales contracts

- Details of all chargebacks or “owner’s salary” in your financials3 years of profit-and-loss statements

*Bonus Tip: If you really want to have an edge on your competition and keep your buyer from even thinking of moving on to the next opportunity, have a current business plan with 2 to 3 years’ projections ready to transition to a new buyer showing future opportunities for the business to succeed.

Wrapping Up

Whatever the reason for selling your business, if it’s time, then get your financial house in order because if you do, or if it already is, this can be the penultimate financial stage of small business ownership. You could realize substantial offers if you can show potential buyers the transferable value of your business.

When it comes right down to it, it’s rather easy to do, especially if you’ve been doing it from the day you launched. Be ready for and head due diligence off at the pass by being transparent and proving upfront your business is consistently profitable solvent, and operating efficiently. Ensure your financials are up-to-date financials by preparing all your documents, your tax returns, your cash-flow statement, and everything else mentioned here.

If you want to ensure you’ve got everything you need or you feel knowing more about how getting your financial records current and organized would help you get a better price for your business, get in touch with a valuation, sale, merger, and acquisition specialist. Muise Mergers & Acquisitions can bring their decades of experience to work for you and tell you more about business value drivers so you can sell your business for more. Take a look at what they can do for you, or email them your questions.